Policy and advocacy unit publication

SUPPLY SHORTAGES IN THE CONSTRUCTION SECTOR 2021

Purpose of this publication.

The purpose of this report is to inform members about construction supply chain shortages that, in mid-2021, have been of concern to Institute members. This report examines some of the indicators using publicly accessible data which help describe the underlying demand, as well as the resulting impact on prices. The shortages and price increases are practical challenges which directly impacts the construction and building projects in which Institute members are engaged.

Shortages

Shortages may include processed or manufactured construction materials such as structural and finishing timbers, insulation, dry-walling (e.g. plaster board), bricks and other cladding material. Shortages can also include manufactured fittings and pre-fabricated building elements.

Supply chain shortages may result from difficulties in sourcing the input raw materials, component materials or parts. These shortages may originate locally or overseas. Delays and/or shortages may result from the specific industries responsible for accessing, processing, manufacturing, fabricating or assembling.

Shortages may also arise from logistics steps in packaging, warehousing, transport, containerising, international cargo, customs, and distribution both overseas and in Australia.

A further dimension to shortages includes labour supply, especially qualified tradespersons and skilled occupations who either construct buildings, undertake specific works, as well as fit or install fittings or service systems.

Indicators of shortages.

Indicators of shortages can include direct measures such as unfilled orders, delays in filling orders, as well as second- and third-degree measures such as the volume of orders and price increases.

This can then result in delayed completions. Other indicators can include the resulting impact on building prices. Drivers for demand for materials and labour may be evident in building permits, commencements and loans data.

Impacts for Architects.

These shortages may have impacts including:

Delaying building projects. This is of particular importance when Architects are also administering a building contract and extension of time or cost claims clauses may become activated.

Needing to source alternative materials. Notwithstanding the original principal’s project requirements brief, materials shortages may also require Architects to work with the client and/or contractor to seek appropriate substitutions that comply with:

- the National Construction Code,

- Australian Standards,

- Statutory Codes or Regulations,

- Local Government by-laws, or

- other locally defined or implemented planning provisions, standards or conditions of permit.

Business impacts. Price increases to total construction costs as well as increased time spent in aforementioned contract administration and sourcing alternatives may have both positive and negative impacts on financial performance of an Architect’s practice. Longer term stagnation in construction, as so-called rebound effect in an over-stimulated economy where demand is greatly in excess of supply and there are inflationary impacts may lead to a situation of stagnation where potential developers or owners delay projects.

Evidence.

Media.

Supply chain shortages in building and construction have been raised at member committees and extensively in both industry and mainstream media. Appendix I provides a sample of reporting in mainstream and industry media as well a government website.

Lending data.

The Reserve Bank of Australia’s monthly report[i] on credit for owner-occupier housing reported 12-month ended growth at June 2021 to be 7.2%, a percentage not seen since the spring quarter of 2018. Total loans for owner occupied housing was close to AU$1.2 trillion ( AU$1182.5 bi).

The volume of loans for investor housing was $639.5 bi. Similarly credit for investor housing reported 12-month ended growth at June 2021 to be 2.0 %, a percentage not seen since May 2018. In fact, growth had been largely stagnant since the beginning of 2019, at less than 1% and in negative growth from April to December 2020.

Loans data should be interpreted carefully. Borrowings can also represent the effect of price increases in markets (not just volume). The data is not separated for new builds, versus purchases of existing properties or renovations. Owner occupied housing loans might also see the use of the borrowers’ loan draw- down facilities for non-dwelling expenditure.

Building Activity data.

Value.

In the March 2021 quarter, the Australian Bureau of Statistics[ii] reported the large financial growth in building activity largely driven through the residential sector and even offsetting declines in non-residential sectors. As Table 1 shows, there was an almost one-fifth (18.5%) increase in total value of alterations and additions (some of this would be activity stimulated by the HomeBuilder scheme).

Mar qtr 21$m | Dec qtr 20 to Mar qtr 21% change | Mar qtr 20 to Mar qtr 21% change | |

Seasonally adjusted estimates(a) | |||

Total value of work done | 30,386.2 | 3.0 | -1.1 |

New residential building | 16,198.8 | 4.8 | 2.6 |

Alterations and additions to residential building | 2,857.7 | 11.4 | 18.5 |

Non-residential building | 11,329.8 | -1.4 | -9.6 |

Source: Australian Bureau of Statistics, Building Activity, Australia March 2021 | |||

Commencements.

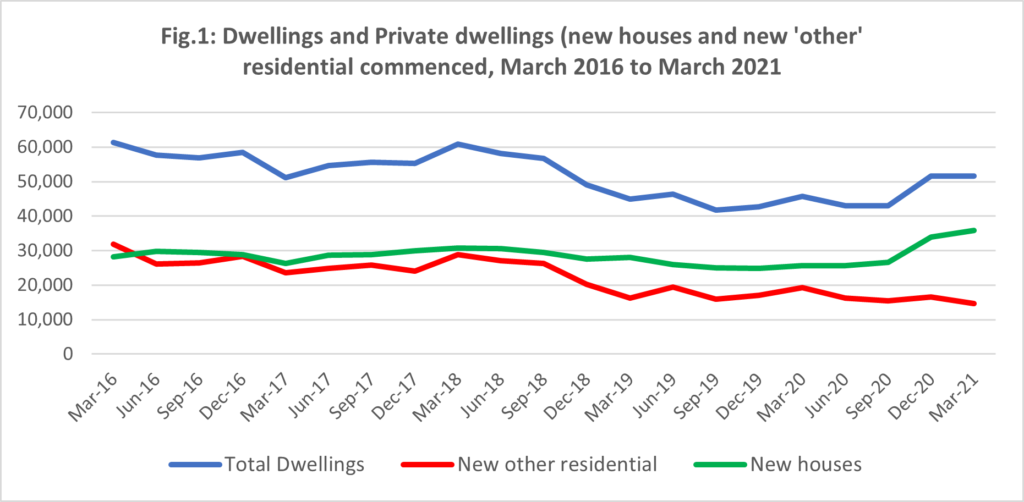

Similarly, numbers of dwelling commencements of 51,662 (see Fig 1 below) reported in the 2021 March quarter represented a 13.1% increase on the 2020 March quarter of 44,848 commencements and a return to levels not seen since the end of 2018.

However, the underlying driver for this was Private Dwelling commencements. As Figure 1 shows, new private houses had soared by 40.15% in the 12 months to 35,869 commencements in March 2021 while new ‘other’ residential had experienced a large negative growth , comprising a 23.8% fall to 14,667 commencements over the same 12-month period. Overall growth was clearly underpinned by new dwellings as demonstrated by the green data series line in the graph.

Price data.

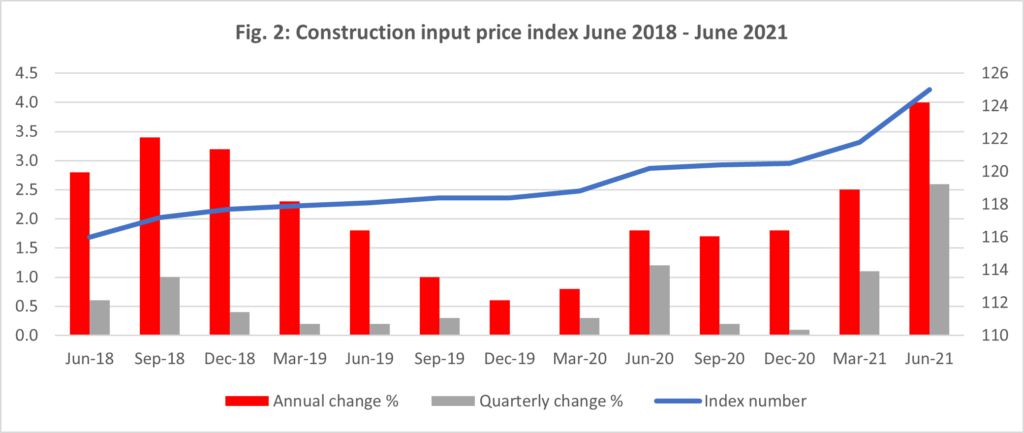

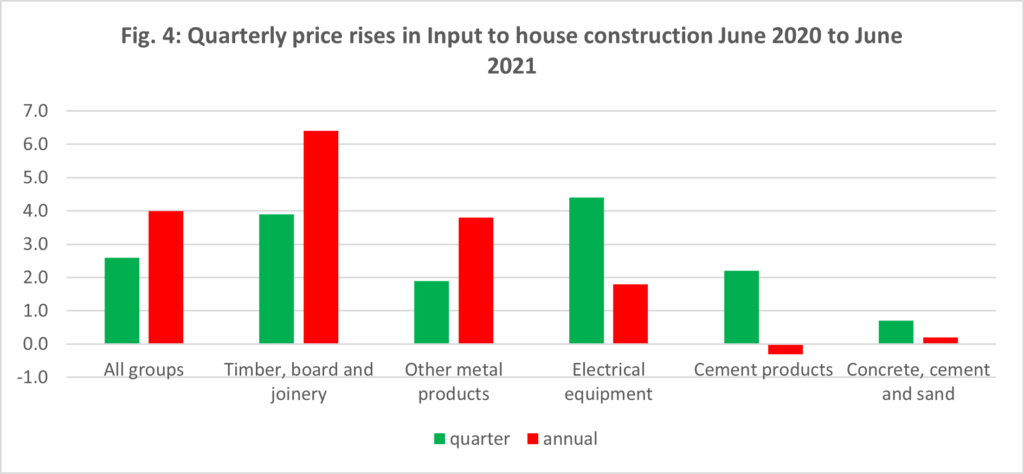

Input prices: The ABS[iii] reported input price increases of 3.9% for Timber Board and Joinery in the June quarter alone (and up to 6.6% for structural timber). The ABS notes,

Input prices to house construction rose due to Federal Homebuilder and state-based grants driving demand for housing. Shortages for some materials have placed further upward pressure on prices.

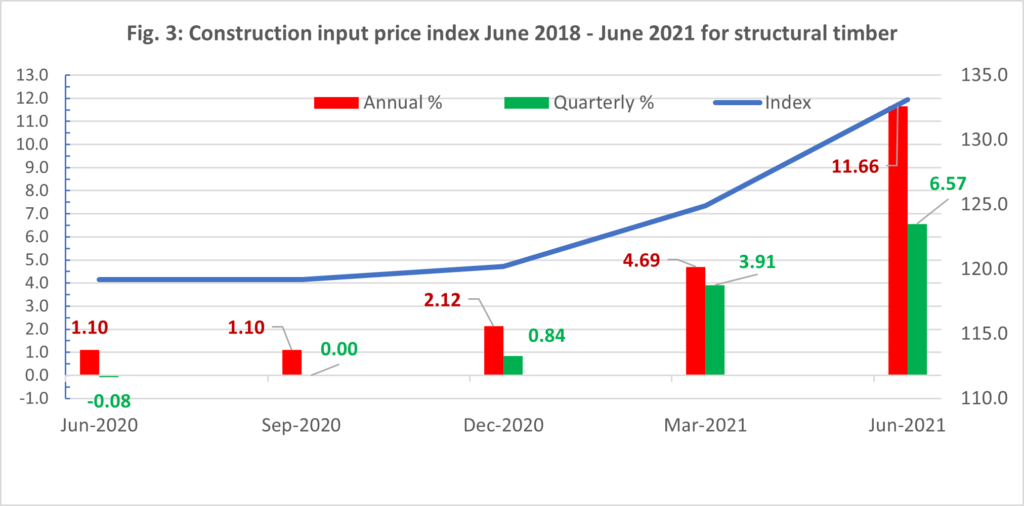

More strikingly, the below graph of ABS data[iv] broken down for different timber types shows that price of structural timber increased by 11.7% in the twelve months from June 2020 to June 2021.

The multiple drivers for input price increases include local supplier capacity (broad business capacity in terms of facilities, equipment), skilled trades workers shortages. overseas impacts of Covid-19 on overseas suppliers and logistics operations, competing overseas demand for Australian exported materials and those of usual suppliers (e.g. NZ), extensive domestic economic stimulus focussed on the built environment, stagnated inflows of migrants and temporary workers, and the reported loss of approximately 10% of plantation timber in bushfire events.

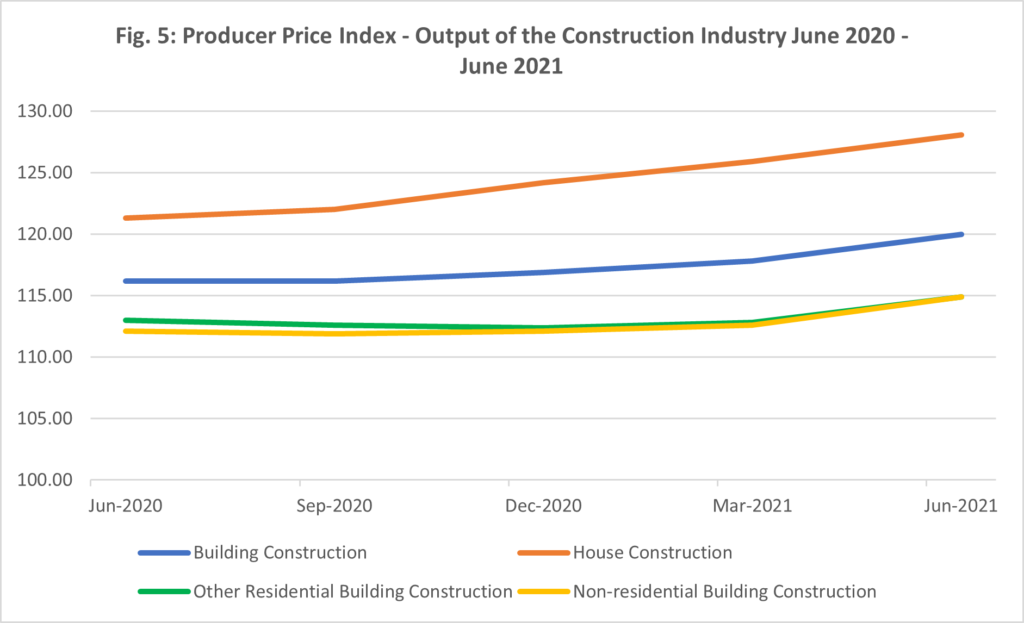

Output prices: Consequent price impacts are seen in the prices of buildings. The graph below, Producer Price Index – Output of the Construction Industry June 2020 – June 2021 constructed from an extract of ABS data[v]

Percentage increases for the long term indexes which date back between twenty-three and twenty-five years show that the single quarter increase (March 2021 to June 2021) was greatest for non-residential buildings at 2.5% and weakest for house construction (1.75%), However the twelve months to June 2021 saw price increases range from 1.68% for Other Residential Building Construction to 5.61% for House Construction. Other residential construction even fell marginally by 0.53% from June 2020 to December 2020 while Non-residential building construction prices remained static over the second half of 2020. In contrast, housing construction output prices had experienced a steady rise.

APPENDIX I

Mainstream, Industry and Government Media Reporting.

National – Australian Financial Review (21-5-21)

https://www.afr.com/policy/economy/why-australia-is-running-low-on-timber-cars-and-pianos-20210519-p57tcp

ACT – ABC (15-4-21)

https://www.abc.net.au/news/2021-04-15/tradie-shortage-leaving-canberra-homes-in-need-of-repair/100035352

NSW – The Sydney Moring Herald (12-7-2021)

Qld – (3-6-21)

https://www.abc.net.au/news/2021-06-03/building-materials-shortage-hits-industry-boom/100181052

South Australia – ABC News (2-6-2021)

Tasmania – The Examiner (6-6-2021)

Victoria – The Age (18-6-2021)

Western Australia – The West Australian (19-7-2021)

https://thewest.com.au/lifestyle/new-homes/work-with-your-builder-on-timber-shortages–c-3421723

Industry bodies and suppliers who have reported shortages include:

Procurement and Supply Australasia (PASA) (17-5-2021)

Master Builders Association

Housing Industry Association.

Mitre 10

https://www.mitre10.com.au/insite/building-boom-sparks-global-timber-shortage/

Government websites:

https://www.qbcc.qld.gov.au/residential-building-material-shortages

REFERENCES.

[i] Reserve Bank of Australia D1 GROWTH IN SELECTED FINANCIAL AGGREGATES. Spreadsheet Published 31-7-2021https://www.rba.gov.au/statistics/tables/xls/d01hist.xls?v=2021-08-05-15-13-34

[ii] Australian Bureau of Statistics. Building Activity Australia. Released 15-7-2021. https://www.abs.gov.au/statistics/industry/building-and-construction/building-activity-australia/latest-release

[iii] Producer Price Indexes, Australia. Released 30/07/2021

[iv] Input to the House construction industry, six state capital cities, weighted average and city, index numbers and percentage changes

[v] Producer Price Indexes, Australia. Released 30/07/2021